Electrical Contractors Insurance - Key Things to Know

Having the right insurance coverage for your electrical business is crucial to your financial well-being. Due to the diversity of exposures that these professionals face, an insurance plan tailored to this profession will need a great deal of specialized and general coverage. It is essential to keep in mind that one bad day could cost you everything you worked so hard to achieve without adequate insurance. However, it isn’t always easy to understand the various electrical contractor insurance requirements.

Read on to learn more about electrical contractor coverage and how you can stay protected.

What Is Electrical Contractor Insurance?

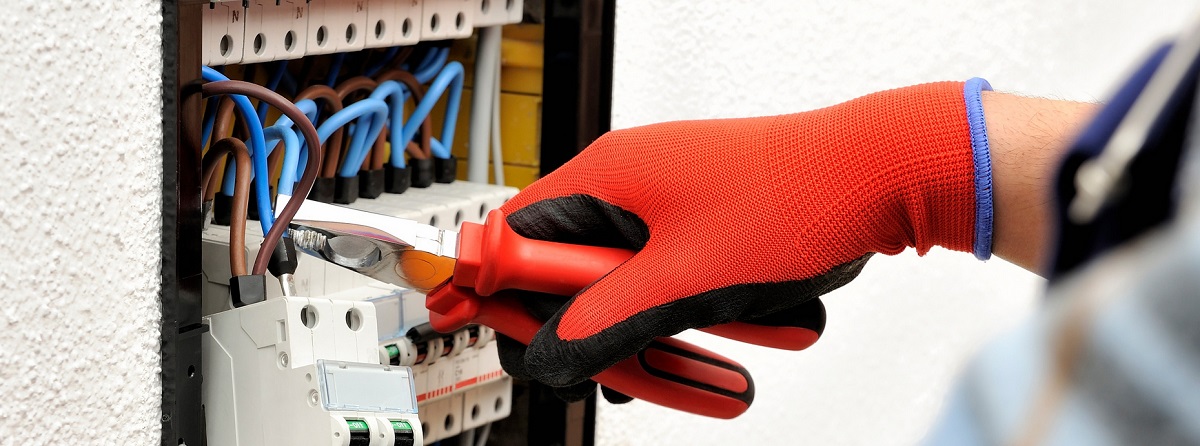

Electrical contractor insurance is focused on protecting electricians and the company they work for (if not self-employed) from damage resulting from negligent work and injuries caused/sustained throughout a day on the job. Plus, it can protect against damage to, or theft of business property.

How Does It Work?

Electrician insurance isn’t a singular form of the insurance policy. Instead, it’s a fusion of policies that electricians may need to use throughout their business. The most common insurance protections that electricians buy include general liability and commercial property insurance. You may also be legally required to have workers’ compensation insurance if you have one or more employees you hire on a part-time or full-time basis.

You can save money on your general liability and commercial property insurance by combining both policies in a single BOP (business owner policy). It gives you the convenience of paying a single premium for your coverage and enables you to access a discount on both policies.

What Does Electrical Contractors Insurance Covers?

An electrical contractors insurance package protects all the business’s core parts and what happens on the job — from the office headquarters to equipment used, to other people and employees working on the job site.

The 3 main components are:

- General liability – Covers any injuries sustained by third parties on the job site and damage to the electrician’s property. It may not pay for work performed that may be lost in an incident, however;

- Workers’ compensation – If the employees become sick, get injured or die from a work-related incident, this type of insurance will pay the benefits required in your state;

- Property coverage – Covers your office space. There is an option to add coverage for equipment and tools used on the job, as well.

Related Content to Small Business Insurance:

- Independent Contactor Insurance Explained: Coverage and Requirements

- Carpenter Insurance 101: Policies & Cost

- Handyman Insurance – Purpose, Coverages, and Cost

- HVAC Insurance Types & Benefits

- Workers Comp Compensation – The Beginner’s Guide

- Ideal Guide to Pick the Right Builder’s Risk Insurance

- Key Facts about Storage Unit Insurance & 5 Tips on How to Find a Perfect Option

- 5 Best Small Business insurance Coverages You Should Consider

- Fire Insurance – Definition, Coverages, and Cost

- Everything You Must Know About Liability Insurance

Types

There are several types of electrical contractor insurance policies that can protect you, your business, employees, and clients. Below are the most common forms of insurance you might need working in the electrical installation and repair industry.

- General liability insurance – If a third-party sustains an injury or their property is damaged due to the services you deliver, professional liability coverage will protect you from the costs connected with medical bills and repair/replacing the damaged property. If a customer files a lawsuit against you, this policy will help pay for legal defense fees. For example, if a faulty connection damages appliances, your CGL (commercial general liability) would help to pay for those damages;

- Workers compensation – If you employ a staff, workers’ compensation insurance is imperative; in most states, it is a legal requirement. This policy will pay for any injuries or illnesses your employees may sustain while on the job. For example, if a worker is connecting wires and is electrocuted, this policy will help cover medical care costs and lost wages. If an employee dies due to an accident, the worker comp will also pay out death benefits to his/her dependents;

- Commercial property – If your business is out of a physical location, it’s a good idea to carry commercial property insurance. It will protect the building your business is located in and the contents within it. If an act of vandalism is committed on your property or building are damaged in a storm, this policy will help pay for any required repairs or replacements;

- Business owners policy – BOP bundles together your general liability and commercial property insurance coverages. This can often provide a more affordable and convenient way to get the insurance protection that you need;

- Errors and omissions – This policy offers protection for any negligence claims filed against you, along with claims stating that you failed in performing a service you promised. This insurance provides coverage for negligence (whether alleged or true), legal defense fees, and damages that happen after you completed the service;

- Commercial auto insurance – Do you or your employees use your vehicles for business? If so, you should consider commercial auto insurance. This offers coverage generally not included in personal auto insurance and can help if you or your employee gets into an accident;

- Health insurance – You have a variety of different options according to your situation. You may want to buy individual marketplace insurance if you are self-employed or a business policy covering yourself and any employees. Steep fines will start to apply if you do not have coverage during the year;

- Contractors’ equipment coverage – You use expensive tools while you are on the job, and if the devices are damaged, the cost of their replacing can be extensive. This policy will protect the tools and equipment you use on job sites.

Other Insurance Coverages to Consider

Depending on your requirements, it may be useful to add other insurance policies.

- Life insurance – If your trade is a partnership or you hire specific employees whose loss would cause severe issues for your business continuity, consider life insurance coverage to help in the event of an unexpected death;

- Business interruption insurance – Whether you encounter a serious illness that disables you for a significant period or a natural hazard that destroys your physical business location, this type of coverage ensures you with the funds to cope with financial glitches;

- Commercial umbrella – This fills in the gaps that conventional insurance policies do not cover. If you need the peace of mind knowing that every possible incident is covered, this is a great option to take into account;

- Cyber insurance – This coverage can be bought as an addition to general liability, professional liability, or BOP policy. It covers costs related to system hacks or data security breaches in which sensitive information has been stolen, and fraud has occurred, or there is a reasonable expectation that it might happen.

FAQs

The cost varies and depends on various factors – the type of business insurance policy, your business’s size, and the work history. Regardless of how much policy costs, insurance for electricians is one of the most significant investments you can make for your business.

It depends on where your business is located. Therefore, check your state and local laws to find out if it is necessary where you are. Also, most states demand, at the least, workers’ compensation, which will cover employees’ medical diagnoses, treatments, and income lost in case they are unable to work because of on-the-job injuries.

Electrician’s insurance only covers third-parties injured or third-party property damaged as a direct result of something your firm did. If you want to insure your employees, it is crucial to have worker’s compensation in case of an accident. Contractors liability can help you obtain workers’ comp alongside your electrician’s insurance general liability insurance policy.

As an electrical contractor, your business is essential; however, it’s also extremely hazardous. Improper connections or faulty wires can spark fires and cause electrocution. Working in tight spaces and climbing ladders could lead to severe injuries. The equipment and tools that you work with are expensive and could be stolen or destroyed. The property that you operate your trade out of could be damaged too.

Due to the inherent risks linked with your business, insurance coverage is a must. And electrical contractors are legally required to carry certain policies. Having the right electrical contractors insurance coverages will protect you from financial losses and ensures that you are compliant with the law.

#1 California Electrical Contractors Insurance

As the leading California electrical contractors insurance provider, we have a unique understanding of the risks that businesses like yours face on a regular basis. With the backing of our comprehensive coverages and our dedication to customer service and quick claims resolution, your business will be fully protected. Our agents will review your needs and help you evaluate which policy makes the most sense for you. We are here to help with all your insurance coverage needs, including specialized plans for electrician contractor insurance.

For more information, call us today at (619) 296-0005 or fill out the form below.